QuickBooks Negative Inventory should be one of the main concerns if you are facing the issue. In this article, we will try to discuss QuickBooks Negative Inventory in detail.

QuickBooks is no doubt one of the most effective software. Small and big business owners use the software to track their transactions and keep track at their fingertips. However, it does have a few demerits like the Negative Inventory. We will discuss all the QuickBooks Negative inventory including the causes, resolution, and precautions. Hence if you are someone who is dealing with the error then read the blog till the end.

What is QuickBooks Negative Inventory?

The Negative Inventor occurs due to some mismatch of the number of sales and the amount of purchase.

Sells Product that is recorded in the Company File

- Buy the product using Items Tab on the item receipt bill, Credit card, bill or check and crediting money, A/P or etc.

- Then you’ll be able to sell the product from the inventory. However, you cannot sell over the stock things.

- Sale dealings record two transactions.

- Editing A/R and crediting sales: Sale/ Receivable transactions.

- Crediting Inventory and debiting COGS: Inventory/ COGS transactions.

- Run the P&L and expense report that shows the invoices and sale receipts.

- Run B/S reports that show item receipts, checks, bills, and credit card charges.

Sells Product that is NOT entered in the Company File

- Make sure you have saved the invoice record for the Sale/ Receivable transactions as expended.

- For the items that are not on hand, the software records them as:

- Equal to the average cost of the other products.

- The pice of the items from the other list.

- OGS/ Inventory record assumes the assumed cost of the product.

- To manage the difference, the software ignores the next transaction and record it as a QuickBooks Inventory adjustment.

What Causes the QuickBooks Negative Inventory?

There are many reasons behind the occurrence of the Negative Inventory Adjustment. The users who are dealing with the QuickBooks Negative inventory must read the following points very carefully.

- The broken information forced you to perpetually build the file to bring the B/S in a balanced type.

- This error can also occur due to the imbalance of the Balance Sheet.

- The amounts of COGS and Profit might be incorrect.

- The data of the Balance Inventory Account is incorrect.

- You could have entered the incorrect seller Reports.

- The system may encounter an overflow error.

- Error: Verify Account Balance failed. Calc bal = 0.00, List bal = *overflow*

- Error: LVL_ERROR–Error: Verify Account: Invalid balance. The amount of overflow has occurred. Rcrd = 99.

- Error: Itemhistupdateengine.cpp — LVL_ERROR–Error: Verify Item History: Bad target COGS for Item.

- Error: Itemhistupdateengine.cpp — LVL_ERROR–Error: Verify item history Target monetary value mate error

How to Resolve the QuickBooks Negative Inventory?

Sales Initial Transaction

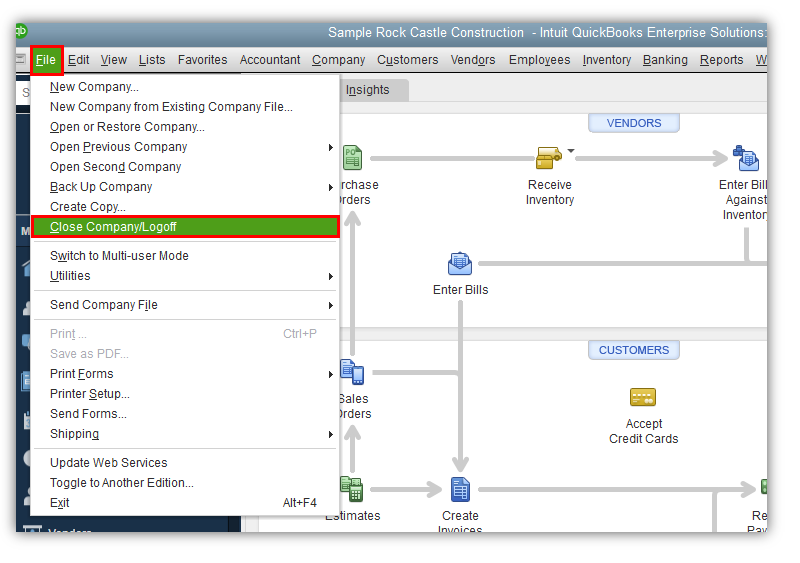

- Navigate the Reports menu and so hit the Inventory.

- After that press on the Inventory Valuation outline.

- QuickZoom and consider the double item displaying inaccurate values.

- Check the initial bill to run the bill window.

- Try to modification and modify the bill date before the date of the beginning invoice.

- Click on the Save possibility and so shut it.

- Check the inaccurate product and so modify it.

Enter Purchase Before Sales

- Change the settings of the dates.

- Follow the Menu bar and so press the reports.

- Go to the Inventory possibility and hit the Inventory valuable detail.

- Choose the drop-down, click on the Dates and so hit the All button.

- Change the date of the bill.

- Save the changes.

Ways to Prevent QuickBooks Negative Inventory

Set up the Inventory things with a gap Balance

- Try to produce the inventory product so enter the specified info.

- Fill in the details of QOH and worth to determine the mean price.

- Purchase before coming into the sale. Avoid it if you are doing not have any product existing.

Use the Sales Orders or Estimate to enter the sales

- Type the order of the client as a procurement Order.

- Or, you’ll be able to additionally enter the client order because of the Invoice.

- Then the user will mark the Invoice as unfinished. To do that, attend the Edit choice so Mark the Invoice as unfinished.

- Make sure you have entered the details of the item in the company file after purchasing the product.

- After following the previous steps, you’ll be able to convert the Sales Order to Invoice otherwise you can even mark the Invoice because of the final one.

Use unfinished Invoice to Enter the Sales that have Inventory

- In the Invoice, enter the client order.

- Then attend the Menu bar, and select Mark Invoice As unfinished.

- Buy the item before coming into it into the company data file

- Go to the menu bar, select the Edit option, and hit the button Mark Invoice as Final.

- Adjust or modification the Invoice date to the cargo date of the things.

Final word!

We have come to the end of the article. In this blog, we have covered all related details regarding the QuickBooks Negative Inventory. It is highly recommended to first read the causes and the symptoms of the error very carefully before performing the methods to fix the issue. If the solutions did not help you to fix the problem, or you have other confusions related to QuickBooks, consider contacting the support team of QuickBooks. You can access the helpline number from the official website of the software. Hopefully, this article was helpful and informative to you.